Analysis of Latest Tungsten Market from Chinatungsten Online

The current tungsten price is generally stable. The main driving forces for the improvement in market sentiment are: (1) after nearly a month of correction, the tungsten market has released some high-price risks and consumed some low-price inventories; (2) after the National Day holiday, although there has been a certain delay in procurement activities, industry insiders generally expect that replenishment work will be gradually carried out, and market confidence is relatively stable; (3) the export control measures implemented by the Ministry of Commerce on key resources such as rare earths and superhard materials, although to a certain extent, have suppressed overseas market demand, but have strengthened the market's long-term optimistic expectations on the value of strategic resources. The tungsten products market has received an additional boost against the backdrop of the overall positive trend of the non-ferrous metals sector.

In the tungsten concentrate market, the reluctance of holders to sell has increased, the supply of low-priced goods in the market has decreased, the market is generally stable, and transactions are limited.

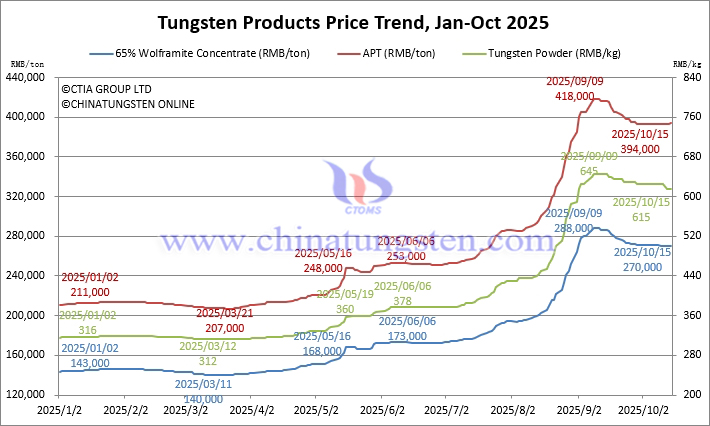

The price of 65% wolframite concentrate was reported at RMB 270,000/ton, down 6.3% from the highest point of the year and up 88.8% from the beginning of the year.

The price of 65% scheelite concentrate was reported at RMB 269,000/ton, down 6.3% from the highest point of the year and up 89.4% from the beginning of the year.

In the ammonium paratungstate (APT) market, long-term contract prices from several representative tungsten companies remained stable, boosting market confidence. However, retail trading remained cautious, with some areas experiencing slight upward movement.

Ammonium paratungstate (APT) prices were reported at RMB 394,000/ton, down 5.7% from the year's peak and up 86.7% from the beginning of the year.

European APT prices were reported at USD 600-670/mtu (RMB 379,000-423,000/ton), up 92.4% from the beginning of the year.

The tungsten powder market, after a post-holiday correction, is currently trading sideways. While stabilizing raw material prices and a rebounding scrap recycling market are providing positive support, consumer confidence still needs to recover, resulting in sluggish market trading.

Tungsten powder prices were reported at RMB 615/kg, down 4.7% from the year's peak and up 94.6% from the beginning of the year.

The price of tungsten carbide powder was reported at RMB 600/kg, down 4.8% from its peak this year and up 92.9% from the beginning of the year.

In the ferrotungsten market, supply and demand are temporarily mismatched, with diverging domestic and international trends.

The price of 70% ferrotungsten was reported at RMB 382,000/ton, down 6.8% from its peak this year and up 77.7% from the beginning of the year.

The price of European ferrotungsten was reported at USD 84-88/kg W (equivalent to RMB 419,000-439,000/ton), up 95.5% from the beginning of the year.

In the tungsten waste and scrap market, trading sentiment has recently improved, with pricing power shifting towards a seller's market and relatively positive market trends.

The price of scrap tungsten bar was reported at RMB 420/kg, down 5.6% from its peak this year and up 90.9% from the beginning of the year.

The price of scrap tungsten drill bits was reported at RMB 400/kg, down 12.1% from its peak this year and up 75.4% from the beginning of the year.

In the cobalt market, supply chain pressures continue to drive cobalt prices upward. Starting October 16th, the Democratic Republic of the Congo will end its nearly eight-month cobalt export ban and begin implementing an export quota policy.

The price of cobalt powder is reported at RMB 450/kg, a 164.7% increase from the beginning of the year.

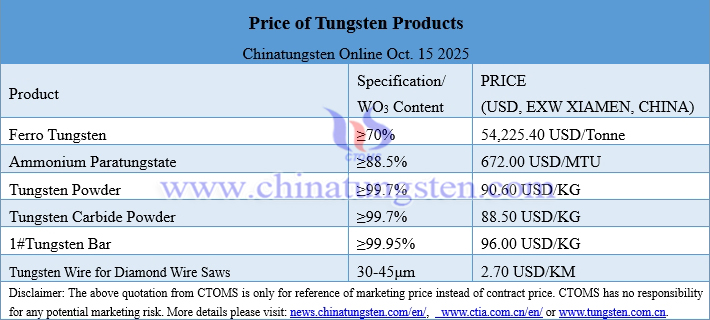

Prices of Tungsten Products on October 15, 2025

Tungsten Price Trend from January to October 15, 2025