Analysis of Latest Tungsten Market from Chinatungsten Online

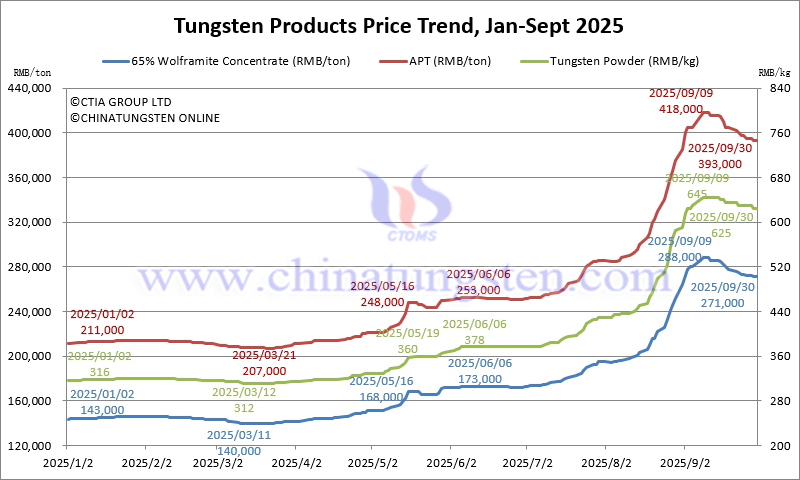

During the first three quarters of 2025, China's tungsten market generally exhibited a trend of "fluctuating upwards, strong gains, and rational corrections." By the end of the cycle, prices of major tungsten products had increased by approximately 90%.

According to China Tungsten Online's long-term tracking, the main drivers of tungsten prices this year can be attributed to three factors: first, supply constraints, including policy cuts, seasonal effects, and sentiment; second, value recognition, driven by increased appetite for safe-haven assets and intensified competition for strategic resources; and third, speculative intervention, with large inflows of investment and speculative funds further driving up prices. On the demand side, while major national infrastructure projects, international military and security reserves, and the development of emerging sectors such as new energy, semiconductors, and nuclear fusion have boosted market demand prospects, consumers' limited tolerance for rapid short-term cost increases has led to a sluggish price transmission mechanism within the tungsten industry chain and relatively limited actual market demand momentum. Amidst this industry supply-demand mismatch, market risks continued to accumulate at high levels, reaching a peak after the September military parade and subsequently entering a period of correction.

Specifically, by quarter:

In the first quarter, prices initially rose, then declined, with slight fluctuations. In January, prices were supported by pre-Spring Festival stockpiling; in February and March, domestic prices came under short-term pressure due to export control policies.

In the second quarter, prices rose strongly, breaking through previous highs. International tungsten prices continued to strengthen due to supply chain issues, widening the price gap between domestic and foreign markets. The first batch of mining volume indicators decreased by 6.45% year-on-year, increasing concerns about supply tightening. Geopolitical tensions in the Middle East highlighted the strategic nature of this resource.

In the third quarter, prices accelerated towards the top before a slight decline. Emotional support peaked before the military parade, leading to a short-term surge of over 40% from August to this point. After the parade, manufacturers resumed production and traders cashed in profits, weakening supply-side support. After doubling in price this year, prices of major tungsten products entered a period of rational correction.

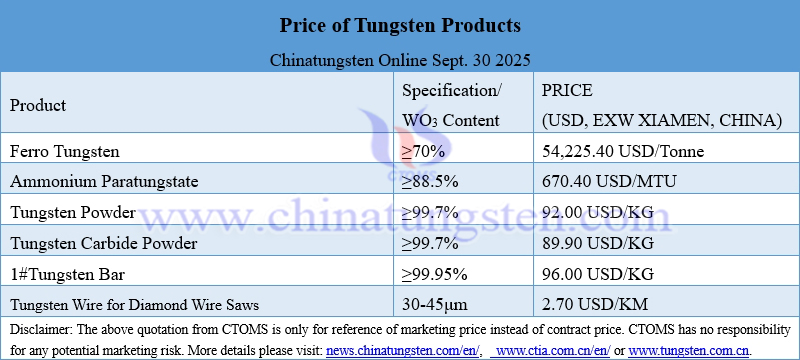

Prices of Tungsten Products on September 30, 2025

Tungsten Price Trend from January to September 30, 2025