Analysis of Latest Tungsten Market from Chinatungsten Online

Tungsten market quotations remained generally stable on Monday, though actual transactions saw slight downward pressure in negotiations. With the approaching long holiday, market trading activity has declined, with most participants adopting a wait-and-see stance, showing reduced initiative in operations, and a short-term deadlock in buying and selling.

In the tungsten concentrate market, tight supply provides some support, but upward momentum is limited. Despite miners' strong intent to hold prices firm, the market faces resistance due to weak terminal demand and liquidity pressures.

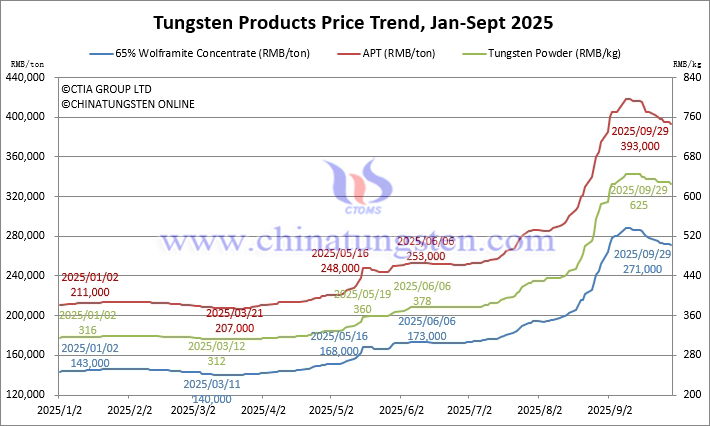

65% Wolframite Concentrate: Priced at RMB 271,000/ton, down 5.9% from its peak, but up 89.5% year-to-date.

65% Scheelite Concentrate: Priced at RMB 270,000/ton, down 5.9% from its peak, but up 90.1% year-to-date.

In the ammonium paratungstate (APT) market, consumption potential remains constrained, and trading sentiment is cautious. Manufacturers are generally concerned about uncertainties in future costs and demand, opting to follow market trends in their operations.

Domestic APT: Priced at RMB 393,000/ton, down 6% from its peak, but up 86.3% year-to-date.

European APT: Priced at USD 580-650/mtu (equivalent to RMB 366,000–410,000/ton), up 86.4% year-to-date.

In the tungsten powder market, dual pressures from costs and demand have led to a slightly weaker but stable trend. Downstream cemented carbide companies show no significant recovery in orders, with limited enthusiasm for raw material procurement, and spot transactions are mostly negotiated.

Tungsten Powder: Priced at RMB 625/kg, down 3.1% from its peak, but up 97.8% year-to-date.

Tungsten Carbide Powder: Priced at RMB 610/kg, down 3.2% from its peak, but up 96.1% year-to-date.

In the ferrotungsten market, supply and demand remain in a stalemate, with transaction activity slightly cooling. Upstream cost support has weakened, and downstream consumption has slowed, creating a relatively pressured market atmosphere, with most participants staying on the sidelines.

70 Ferrotungsten: Priced at RMB 385,000/ton, down 6.1% from its peak, but up 79.1% year-to-date.

European Ferrotungsten: Priced at USD 80-82/kg W (equivalent to RMB 399,000–409,000/ton), down 3.4% from its peak, but up 84.1% year-to-date.

In the tungsten waste and scrap market, trading shows mixed gains and losses, with a wait-and-see sentiment prevailing. Recent inquiries have slightly increased, stabilizing the market, but participants hold divergent views on future trends, with some holding back in anticipation of price rises while others cash out.

Scrap Tungsten Bar: Priced at RMB 385/kg, down 13.5% from its peak, but up 75% year-to-date.

Scrap Tungsten Drill Bit: Priced at RMB 370/kg, down 18.7% from its peak, but up 62.3% year-to-date.

Prices of Tungsten Products on September 29, 2025

Tungsten Price Trend from January to September 29, 2025