The rise in tungsten prices has an uneven impact on various segments of the industrial chain, presenting a "smile curve":

Upstream (Mining/Smelting)

Profit margins are highest. Large mining companies with quotas benefit from significantly higher selling prices, leading to significant improvements in gross profit margins. For example, Xiamen Tungsten has significantly increased its resource self-sufficiency rate through asset injections. In the first half of 2025, tungsten and molybdenum revenue accounted for 46.21%, benefiting from a year-on-year increase of over 68% in tungsten concentrate prices. Market prices showed an upward trend during the reporting period, with the average price of tungsten concentrate and APT increasing compared to the same period last year. Meanwhile, national controls on total tungsten mining have led to a slight reduction in supply, but demand remains strong, particularly in advanced manufacturing and defense industries, where tungsten products have broad application prospects. The company's output in tungsten deep processing continues to rank among the top domestic producers, and its market share in cemented carbide and cutting tools has also increased. China Tungsten High-Tech's revenue in the first half of the year was 7.849 billion yuan, a year-on-year increase of 15.31%; net profit attributable to the parent company was 510 million yuan, a year-on-year increase of 247.28%; net profit attributable to the parent company after deducting non-recurring items was 484 million yuan, a year-on-year increase of 310.54%; and basic earnings per share was 0.24 yuan.

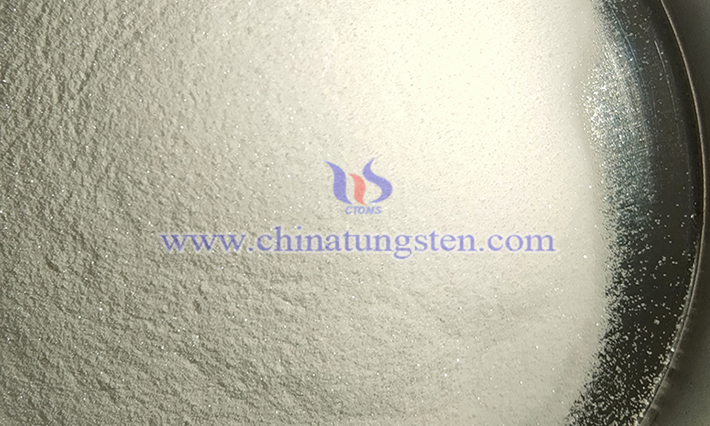

Midstream (APT, powder)

Smelting companies are facing short-term pressure. Smelting companies are facing rapidly rising raw material procurement costs, but leading companies are expected to partially pass on these costs through long-term contract negotiations and product price increases. APT manufacturers are expected to see profit margins of around 10% in 2025.

Downstream (carbide and tool products)

The pressure is greatest. There is a lag in the price transmission of terminal products. Faced with the rapid rise in tungsten powder/tungsten carbide powder, the profits of small and medium-sized processing enterprises have been severely squeezed. As of September 2025, many companies have reported to China Tungsten Online that their gross profit margins have dropped to around 10%. Most small and medium-sized enterprises are faced with the difficult choice of raising the selling price of finished products, reducing gross profits or delaying purchases. Alloy companies that lack funds, technological advantages and product market advantages have to reduce production and may even have to shut down to stop losses.