Capital and market sentiment have played a significant role in amplifying fluctuations in this round of price increases. Market data shows that capital has played a significant role in driving tungsten price increases. Price updates are quickly reflected within hours through share price fluctuations of related concept stocks in the secondary market.

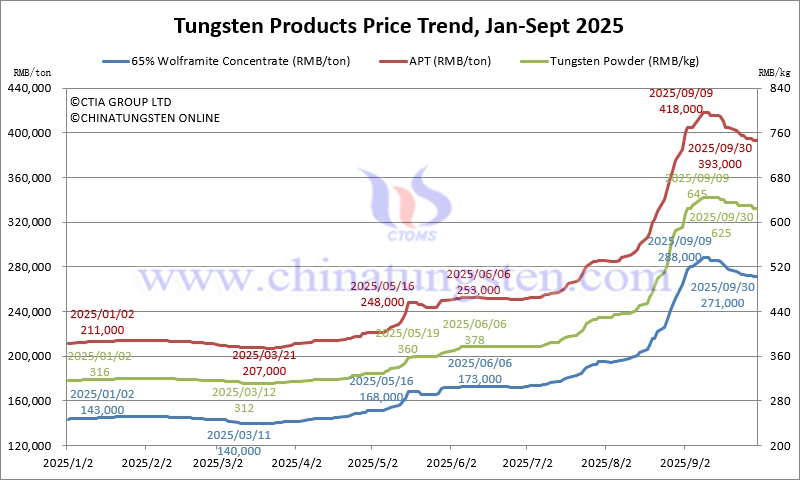

According to China Tungsten Online's daily tungsten price data on WeChat, the APT price rapidly approached the RMB 400,000/ton mark from RMB 290,000/ton in mid-to-late August, reaching a peak of RMB 418,000/ton in early September, a monthly increase of 44%. This step-by-step increase clearly reflects the influence of emotional capital and short-term speculators, exacerbating panic buying in the market.

During this period of tungsten price surge, tungsten-related concept stocks saw increases of more than 40%, and trading volume also surged significantly, demonstrating the strong role of capital in driving price increases.

Analysis indicates that the specific manifestations of the impact of capital and funding include the following:

I. Amplified Market Sentiment

Price alerts triggered a rapid reaction in the secondary market, causing significant price fluctuations in concept stocks within hours.

The surge in APT prices from August to early September was driven by emotional capital, exacerbating panic buying.

Speculative trading increased, significantly boosting speculative positions in the market.

II. Capital Inflows and Stock Price Drivers

In August 2025, tungsten resource-related concept stocks saw an average increase of approximately 40%.

Compared to the beginning of the year, trading volume surged 700%, reflecting a concentrated influx of funds.

International investment institutions invested in tungsten-related ETFs, significantly increasing capital inflows into the industry.

III. Speculation and Inventory Impacts

Traders' stockpiles reached a record high, extending inventory turnover to 18 days in August. Speculative capital is driving up price elasticity, with APT prices reaching a historic peak of RMB 418,000/ton on September 9th.

IV. Policy and Capital Interaction

Export controls are reinforcing market expectations of scarcity, attracting capital attention.

The country's strategic resource positioning has been enhanced, and low financing costs are stimulating capital inflows.

Concept stocks are undergoing a revaluation.

V. Global Capital Game

APT inventories in the European and American markets are decreasing, and capital is shifting to the Chinese market, pushing up prices.

Geopolitical tensions are stimulating demand for strategic reserves, with capital chasing tungsten resource stocks.

The global economic recovery is driving a rebound in the manufacturing industry, indirectly amplifying the capital effect.

The combined influence of multiple factors on the capital and funding fronts will significantly amplify market volatility during the tungsten price increase in 2025. Short-term sentiment retreat will trigger price fluctuations, while long-term capital allocation may further solidify the price center.