National policies, combining "domestic mining control and foreign export regulation," have significantly impacted the supply and demand structure of the tungsten market.

On February 4, 2025, the Ministry of Commerce and the General Administration of Customs issued an announcement imposing export controls on various tungsten products and related technologies, including ammonium paratungstate (APT), tungsten oxide, and tungsten carbide. Export licenses require specific end-users and intended uses, strengthening review and oversight. Based on practical experience, the approval process has been extended to 30-60 days. This reinforces the perception of "domestic supply priority," further exacerbating global supply constraints. According to data from the General Administration of Customs compiled by China Tungsten Online, China's tungsten product exports (excluding carbide tools and halogen lamps) totaled 7,257.99 tons in the first half of 2025, a year-on-year decrease of 23.94%. The cumulative import value was RMB 2.239 billion, a year-on-year decrease of 14.57%.

As previously mentioned, the Ministry of Natural Resources issued a total mining control target of 58,000 tons (based on a 65% tungsten trioxide content) in April 2025, a decrease of approximately 6.45% from 62,000 tons in 2024 (Ministry of Natural Resources notice), tightening domestic mining capacity.

The combined effects of these two policies have significantly heightened market concerns about supply shortages, becoming the core driver of price increases.

Furthermore, on May 9, 2025, my country launched a special campaign to combat the smuggling and export of strategic minerals such as tungsten and rare earths, further exacerbating international market anxiety about tungsten supply and spurring stockpiling and speculation.

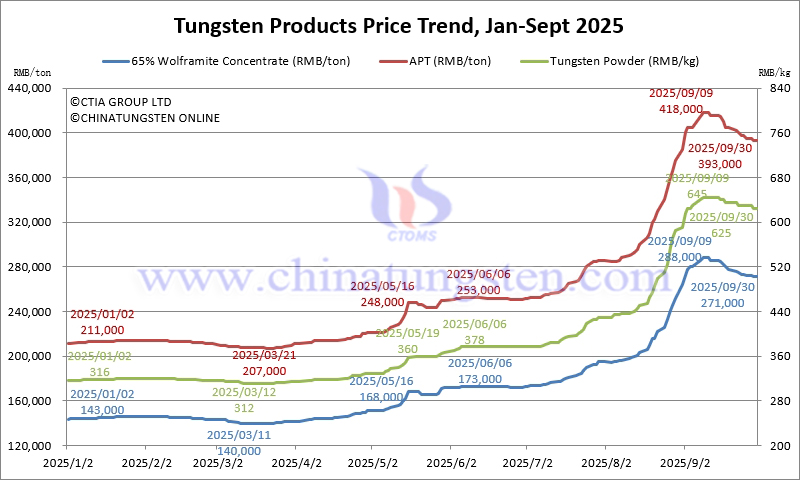

The cumulative effect of these policies has driven up tungsten prices, with prices of major tungsten products doubling within six months. According to statistics from China Tungsten Online, from March 21 (the lowest price of the year to date) to September 9 (the highest price to date), the price of 65% wolframite concentrate rose from RMB 140,000/ton to RMB 288,000/ton, a 105.7% increase; the price of APT rose from RMB 207,000/ton to RMB RMB 418,000/ton, a 101.9% increase; and the price of tungsten powder rose from RMB RMB 316,000/ton to RMB 645,000/ton, a 106.7% increase.

More importantly, China Tungsten Online analysis indicates that the primary suppliers of tungsten product raw materials are large, state-owned listed companies, which have advantages in capital and resources. The government's more stringent and standardized requirements for listed companies create short-term profit pressure, thereby creating an inherent driving force for rising prices.

The combined effect of these policy measures has exacerbated the tungsten supply shortage in the short term, and it is not expected to ease until the first quarter of 2026. However, in the long term, it will reshape the global tungsten supply chain.