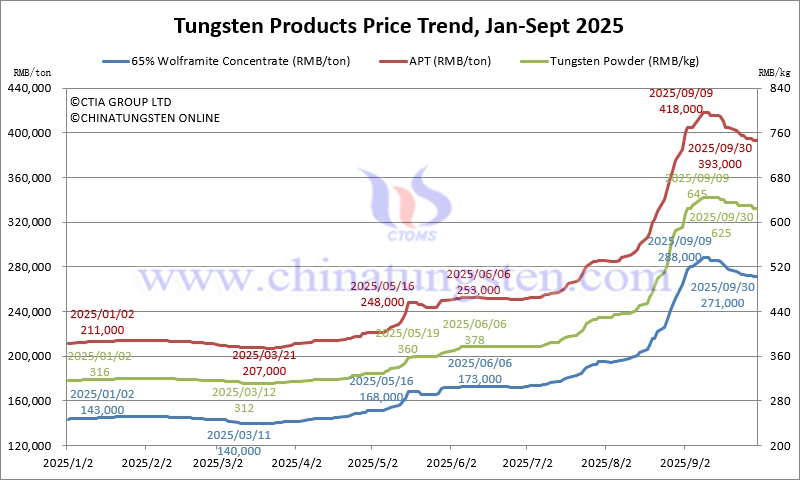

Since March 2025, China's tungsten prices have continued to rise, with a temporary surge in August, reaching a historical peak in early September, and doubling the price of major tungsten products this year.

As of the end of September 2025, despite some decline, the price of 65% wolframite concentrate had risen rapidly from RMB 143,000/ton at the beginning of the year. After peaking at RMB 288,000/ton in early September, it fell back to RMB 271,000/ton, still up approximately 89.5% from the beginning of the year. The price of ammonium paratungstate (APT) rose from RMB 211,000/ton at the beginning of the year to RMB 393,000/ton, an increase of approximately 86.3%. The price of tungsten powder rose from RMB 316,000/ton at the beginning of the year to RMB 625,000/ton, an increase of approximately 97.8%. This round of price increases began at the end of the first quarter of 2025, accelerated in the second quarter, and reached a peak in the third quarter.

European APT prices have also hit new highs, rising from USD 320-340/mtu at the beginning of the year to USD 580-650/mtu, an increase of 86.4% this year, reflecting the worsening global supply and demand imbalance.

Based on various historical data and professional analysis of China Tungsten Online, the main reasons for the increase in tungsten prices include the following aspects:

I. Supply-side contraction

(1) The total mining volume of the first batch of tungsten ore (tungsten trioxide content 65%) in 2025 is controlled at 58,000 tons, which is 4,000 tons less than the first batch in 2024, a decrease of 6.45%. Among them, Heilongjiang, Zhejiang, Anhui and Hubei provinces did not allocate quotas, while the allocated quotas of Jiangxi, Guangdong, Guangxi, Yunnan, Gansu and Xinjiang decreased by 10.01%, 10.17%, 10.00%, 10.40%, 0.32% and 0.34% year-on-year respectively.

(2) The high pressure of environmental protection policies has led to the domestic mine operation rate being less than 35% (August statistics).

(3) Spot inventory has dropped to 14-16 days (August average).

(4) The average grade of tungsten ore in China has dropped from about 0.42% to the current 0.27% over the past 20 years.

(5) Rising energy and labor costs have pushed up the cost of tungsten concentrate mining.

(6) Resource depletion and the long production cycle of new mines (average 6-10 years).

(7) High temperatures, heavy rains and floods in summer have caused some mines in Hunan and Jiangxi to reduce or stop production to varying degrees.

(8) The aging of mining equipment and the need for intelligent transformation have affected production, and some mines and smelting equipment need to be updated.

(9) Transportation costs increased. The transportation costs of tungsten ore increased nationwide in August.

(10) Explosives control during important events affected mining.

(11) The nationalization of tungsten ore increased, and the control capacity and strength were thoroughly implemented, which was conducive to the implementation of trade policies.

(12) Social capital attention increased, and the market expectations and preparations for the futures of tungsten products were realized.

(13) High prices promoted the rapid development of environmental protection policies and circular economy in the industry.

(14) High prices truly reflected the industrial and strategic value of tungsten due to its scarcity and advanced mining and smelting technology.

II. Demand side explosion

(1) Demand surged in the military sector. A report released by the Stockholm International Peace Research Institute (SIPRI) in Sweden pointed out that the continued escalation of geopolitical tensions has become the core factor driving the rise in global military spending, with the increase in Europe and the Middle East being particularly significant. In 2024, global military spending will increase to approximately USD 2.72 trillion, a real increase of 9.4% over 2023. This is the tenth consecutive year of global military spending growth, with a cumulative increase of 37%.

(2) In 2025, China's military tungsten product orders will increase significantly year-on-year, and the demand for tungsten-based alloys such as armor-piercing bullets and missile components will increase significantly. Some companies will schedule orders after 2026.

(3) The penetration rate of photovoltaic tungsten filaments in the new energy field will increase from 20% in 2025 to 60%. Each GW photovoltaic module consumes 8.2 tons of tungsten. In 2025, global demand will exceed 4,500 tons (a year-on-year increase of 198%). The long-term penetration rate is expected to exceed 80%, and the growth will continue.

(4) Adding tungsten to lithium-ion battery positive electrode materials can increase energy density. In 2025, tungsten consumption in the power battery field increased by 22% year-on-year.

(5) The technology roadmaps released intensively by many car companies and battery manufacturers show that 2027 is expected to be the first year for all-solid-state batteries to be installed in vehicles, and large-scale commercial use will be achieved in 2030. This technological change will not only reshape the new energy vehicle industry landscape, but will also drive an increase in demand for tungsten sulfides and oxides.

(6) In the field of high-end manufacturing, the demand for tungsten alloys in nuclear fusion research is showing an upward trend. Among them, the demand for high-end tungsten copper and other tungsten alloys in the nuclear fusion projects in Hefei and Shanghai is expected to increase significantly.

(7) The Yarlung Zangbo River Hydropower Station, the Xinjiang-Tibet Railway and the C919 large aircraft project have significantly driven the demand for cemented carbide.

(8) High-end drones, unmanned submarines and unmanned spacecraft have become new growth points in the tungsten market.

(9) The global semiconductor industry is recovering, and the demand for tungsten targets will increase in 2025. According to online data, driven by the semiconductor, photovoltaic and display panel industries, the annual growth rate of demand for high-purity tungsten targets exceeds 15%. The market size in 2024 is about USD 12 billion, and it is expected to exceed USD 13 billion in 2025.

III. Policy and international factors

(1) On December 3, 2024, the Ministry of Commerce decided to strengthen the export control of relevant dual-use items to the United States and prohibit the export of dual-use items to US military users or military purposes. Among them, tungsten products included in the "Export Control List of Dual-Use Items of the People's Republic of China" include tungsten-containing solid propellants and tungsten, tungsten carbide and tungsten-containing alloys with certain characteristics.

(2) On February 4, 2025, China implemented export controls on tungsten-related items such as ammonium paratungstate, tungsten oxide, tungsten carbide not controlled under 1C226, and solid tungsten and tungsten alloys with certain characteristics.

(3) In March 2025, China's export data for tungsten trioxide, unlisted tungsten oxides and hydroxides, ammonium paratungstate, and tungsten carbide due to dual-use export controls was zero.

(4) On May 9, 2025, the Office of the National Export Control Coordination Mechanism deployed and held an on-site meeting on a special operation to combat the smuggling and export of strategic minerals. The meeting pointed out that strengthening export controls on strategic mineral resources is related to national security and development interests. Since the country implemented export controls on strategic minerals such as gallium, germanium, antimony, tungsten, and medium and heavy rare earths, some overseas entities have colluded with domestic illegal personnel to continuously innovate smuggling and export methods in an attempt to evade crackdowns. In order to prevent the illegal outflow of strategic minerals, curb the momentum of smuggling, and effectively safeguard national security, while promoting compliant trade and ensuring the stability of the supply chain, combating the smuggling of strategic minerals has become an urgent and important task.

(5) In 2025, the United States will impose tariffs of up to 245% on Chinese imports. However, when it announced the implementation of the so-called "reciprocal tariff", it also issued a tariff exemption list, including tungsten ore, tungsten concentrate, tungsten oxide, tungsten carbide, tungsten iron and silicon tungsten iron, tungsten powder, tungsten scrap, etc.

(6) On July 4, 2025, the United States signed the "Big and Beautiful" Act, which provided USD 500 million in credit subsidy funds to the U.S. Department of Defense Strategic Capital Office and created up to USD 100 billion in available loan funds specifically for critical mineral production and related industries and projects, including a USD 6.2 million grant to Guardian Corporation to advance the Pilot Mountain tungsten mine project in Nevada, aiming to restart the domestic tungsten supply chain that had been interrupted for nearly a decade.

IV. Market Sentiment and Capital Operation

(1) Expectations of tight supply have led to increased stockpiling by traders.

(2) The inflow of financial capital and the rise in tungsten prices have pushed up tungsten-related concept stocks.

V. Macroeconomics and Industrial Cycle

(1) The global manufacturing PMI rebounded in 2025, indirectly driving the demand for tungsten.

(2) China's "14th Five-Year Plan" plans a substantial increase in high-end manufacturing investment by 2025, which indirectly drives tungsten consumption.

(3) The inflation rate has risen, wages and medical and social security have increased, and the cost of raw materials has generally risen.

(4) Tungsten price sensitivity has increased, and the spot premium rate has increased significantly in July, August and September.

(5) Rising energy prices have pushed up the overall production cost of tungsten products. From high-temperature heating in the smelting process to the operation of equipment for deep processing, the tungsten industry chain, which consumes more than 30% of energy, is significantly affected by energy price fluctuations, resulting in increased product production costs.

The combined effect of these factors has led to an unprecedented upward trend in tungsten prices in 2025. There is a clear trend of high-level fluctuations in the short term, and a trend of long-term value reassessment has also emerged. China Tungsten Online predicts that the price center of tungsten concentrate is expected to exceed RMB 400,000/ton in 2030.