Analysis of Latest Tungsten Market from Chinatungsten Online

Tungsten prices are generally stable, with some divergence in market sentiment. From a fundamental perspective, miners are reluctant to sell at low prices due to cost and supply factors, while powder metallurgy companies are cautious purchasing due to demand pressures. The current tungsten market negotiation atmosphere is rather delicate. From a macro perspective, the international economic and geopolitical situation remains uncertain, with weak demand reality and strong expectations competing on the demand side. The differing confidence between physical consumers and investors/speculators is impacting tungsten market sentiment and liquidity.

In the tungsten concentrate market, the smelting sector has strong absorption capacity, resulting in a remaining tight supply of raw materials. However, limited downstream demand momentum is constraining market buying and selling, resulting in a short-term stabilization.

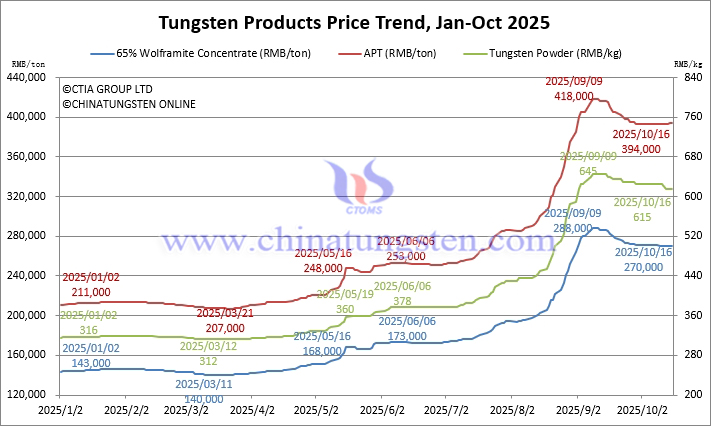

The price of 65% wolframite concentrate was reported at RMB 270,000/ton, down 6.3% from its high this year and up 88.8% from the beginning of the year.

The price of 65% scheelite concentrate was reported at RMB 269,000/ton, down 6.3% from its high this year and up 89.4% from the beginning of the year.

In the ammonium paratungstate (APT) market, cost and demand factors remain volatile, resulting in a cautious trading atmosphere and a stable market.

The price of ammonium paratungstate (APT) is reported at RMB 394,000/ton, down 5.7% from its peak this year and up 86.7% from the beginning of the year.

The European APT price is reported at mtu 600-670/mtu (equivalent to RMB 379,000-423,000/ton), up 92.4% from the beginning of the year.

In the tungsten powder market, traders are currently maintaining a neutral stance, with cautious trading and a wait-and-see approach to the supply and demand dynamics in the supply chain.

The price of tungsten powder is reported at RMB 615/kg, down 4.7% from its peak this year and up 94.6% from the beginning of the year.

The price of tungsten carbide powder is reported at RMB 600/kg, down 4.8% from its peak this year and up 92.9% from the beginning of the year.

In the ferrotungsten market, domestic consumption activity has cooled, with the market center of gravity weak and stable. The international market remains tight on supply, with overall strength.

The price of 70% ferrotungsten is reported at RMB 382,000/ton, down 6.8% from its peak this year and up 77.7% from the beginning of the year.

The European ferrotungsten price is reported at USD 86-89.5/kg W (RMB 429,000-446,000/ton), up 99.4% from the beginning of the year.

In the tungsten scrap market, participants are increasingly divided, with reluctance to sell and cashing out coexisting. The overall amount of liquid resources has increased, and the transaction price spread has widened.

The price of scrap tungsten bars is reported at RMB 420/kg, down 5.6% from its peak this year and up 90.9% from the beginning of the year.

The price of scrap tungsten drill bits is reported at RMB 400/kg, down 12.1% from its peak this year and up 75.4% from the beginning of the year.

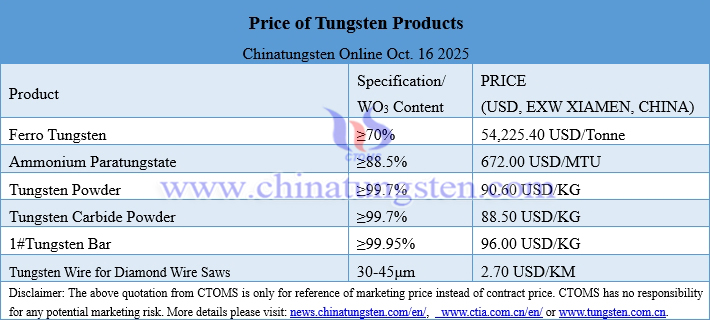

Prices of Tungsten Products on October 16, 2025

Tungsten Price Trend from January to October 16, 2025