Analysis of Latest Tungsten Market from Chinatungsten Online

Although tungsten market trading has gradually recovered after the National Day holiday, total transaction volume remains limited. With demand currently cyclically weak, prices for major tungsten products remain under pressure and in a state of rational adjustment. Based on historical cyclical patterns and industry fundamentals, industry insiders believe the market will maintain a rational, small-scale adjustment in the short term, avoiding significant fluctuations while awaiting policy and macroeconomic signals. However, with the gradual release of traditional inventory replenishment demand in the fourth quarter and the need for year-end corporate financial report optimization, the tungsten industry chain is expected to see a temporary rebound in the fourth quarter.

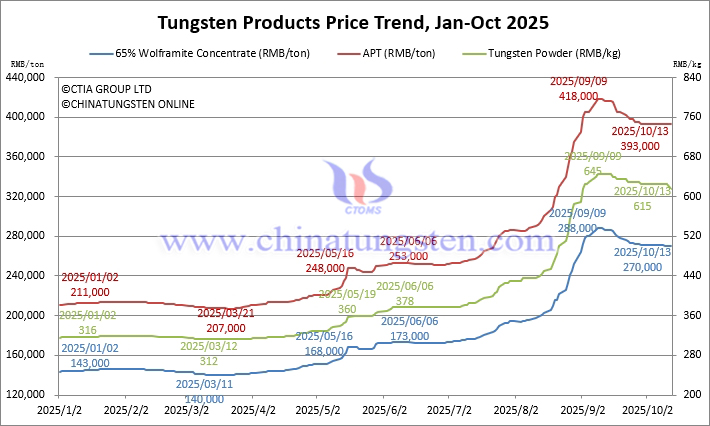

The tungsten concentrate market remains relatively stable. Although there is a time lag in downstream demand transmission, some mining companies are reluctant to sell due to optimism about the future market, providing a floor for prices. The current price of 65% wolframite concentrate remains stagnant at around RMB 270,000/ton.

The ammonium paratungstate (APT) market continues to follow market trends. Due to the price-supporting behavior of miners and the downward pressure on downstream purchases, smelters remain cautious in the tug-of-war between supply and demand. Currently, there is little willingness to sell at low prices, and the mainstream price remains around RMB 393,000/ton.

The tungsten powder market is showing signs of weak downward adjustment under pressure. For tungsten powder, limited resource availability and continued orders from established customers have kept merchants relatively confident, leading to a rational market adjustment and a price of around RMB 615/kg.

Tungsten carbide powder, on the other hand, is facing relatively weak fundamentals. Consumption pressure in the cemented carbide sector has increased buyers' bargaining power, forcing powder manufacturers to offer lower prices. Mainstream tungsten carbide powder prices have fallen to RMB 595-600/kg, with some low-priced resources dropping below RMB 590/kg.

The tungsten waste and scrap market saw a temporary rebound after the holiday, primarily due to a technical correction following the pre-holiday price drop and increased buyer demand driven by sentiment. Scrap tungsten bar prices rebounded to RMB 410/kg, while scrap tungsten drill bit prices were around RMB 390/kg.

International tungsten prices continued their upward trend. As of press time, the European APT price was USD 600-670/mtu (RMB 379,000-423,000/ton), a 92.4% increase from the beginning of the year. The price of European ferrotungsten is reported at USD 84-88/kg W (equivalent to RMB 419,000-439,000/ton), up 95.5% from the beginning of the year.

Prices of Tungsten Products on October 13, 2025

Tungsten Price Trend from January to October 13, 2025