Molybdenum market update on October 10, 2025

The domestic molybdenum market overall maintains a firm operation, with low consumer enthusiasm among downstream users and strong reluctance among suppliers to lower prices, resulting in low market trading activity, no significant changes in product prices, and limited actual transaction volumes. Currently, traders are awaiting guidance from the next round of steel bidding prices.

From the perspective of favorable factors, firstly, the supply of raw material spot goods is limited: molybdenum concentrate production slightly decreased in the first three quarters of the year, and with some intermediate smelting enterprises currently undergoing maintenance shutdowns, the growth of ferromolybdenum production is constrained. Secondly, supported by robust development in downstream steel industries, steel enterprises have a high demand for ferromolybdenum, with a total of approximately 115,000 tons tendered from January to September, increased by 6.78% year-on-year. Thirdly, the oscillatory upward trend in international molybdenum prices is beneficial to warming up the domestic molybdenum market.

From the perspective of unfavorable factors, firstly, with the National Day holiday just ended, some downstream users have not yet initiated their procurement plans, leading to low market transaction volumes. Secondly, influenced by the weaker domestic molybdenum market performance before the holiday and the persistent pressure from steel enterprises to lower ferromolybdenum prices, suppliers generally lack confidence in raising prices.

In terms of news, according to Huanqiu.com, the European Union plans to significantly reduce import quotas for steel exempt from tariffs and increase tariffs on amounts exceeding the quotas to 50%. According to Radio France Internationale, this unprecedented measure announced by the EU on the 7th includes reducing the annual quota for tariff-free foreign steel imports to the EU by 47% to 18.3 million tons, doubling tariffs on amounts exceeding the quota from 25% to 50%. Additionally, EU importers will be required to declare the country where the original metal was "melted and cast" to prevent tariff evasion.

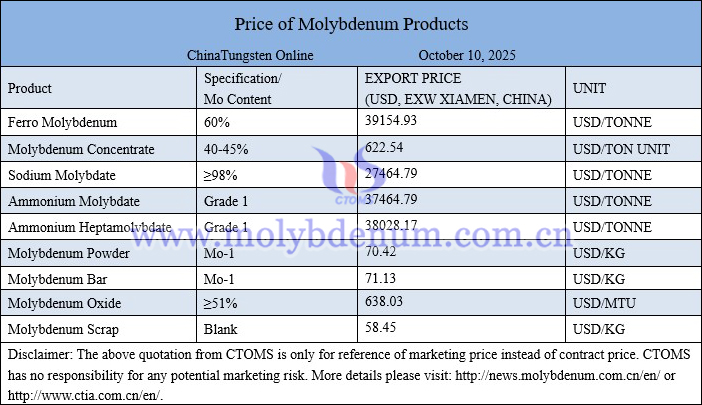

Price of molybdenum products on October 10, 2025

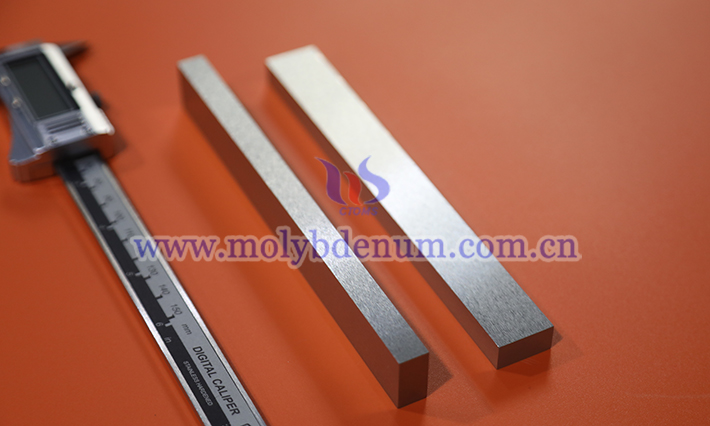

Molybdenum bar images